Why Rare Earth Magnets Are So Hard to Replace

Interview with Prof. Dr. Oliver Gutfleisch, TU Darmstadt

By Nicole Horner, ESM Foundation

Addressing challenges associated with rare earth elements is crucial for the sustainable advancement of magnetic technologies. While rare earths possess unmatched chemical, electronic, optical and magnetic properties, their limited, concentrated and environmentally problematic supply prompts the exploration of alternative materials, innovative processing techniques, and other strategies. Dr. Oliver Gutfleisch, Professor for Functional Materials at the Technische Universität Darmstadt, discussed the state of research with us.

If you’ve ever used a smartphone, driven an electric vehicle, put on headphones or turned on an LED light, chances are you’ve encountered rare earth elements. If you think about essential components in technologies such as wind turbines, electric vehicles, data storage, robotics, magnetic refrigeration and advanced energy systems you are deeply in the rare earth business and you will recognize that magnetic materials are central in these transformative processes.

They are also unavoidable in our current news cycle. Just last week, China suspended restrictions announced last month on the export of rare earths. Rare earths and in particular the powerful magnets that contain them are vital for civilian and military applications. Which is why ensuring access to them is at the top of many countries’ political agendas. And the difficulty of replacing rare earths has sparked efforts to discover viable alternatives.

Why Are Rare Earths “Critical”?

To understand why ensuring reliable, affordable and secure access to rare earths remains such a challenge for many countries, we need to look at their history.

“Before we get to this, let me emphasize that rare earths, at least most of them, are NOT rare! That is a historical misnomer and a problem for the public debate. They have a very exciting, if you want, entertaining, and everyday changing history, starting with their discovery in 1794 in a little mine next to Stockholm called Ytterby”, Gutfleisch states. “Before 2000, the US Mountain Pass Rare Earth Mine had dominated the rare earth market. But then, for economic and local ecological reasons and the hard push by Deng Xiaoping to bring the strategic governance of the rare earth market to China, everything shifted.”

In 1992 Deng Xiaoping famously said: “The Middle East has oil and China has rare earths.” Gutfleisch explains that Deng Xiaoping’s push led to China gaining profound knowledge on rare earth separation, that has been largely lost in the Western world and now needs to be regained.

“The first steps of the rare earth value chain, mining and beneficiation, have diversified over the last 10 years. In 2010, with the first so-called ‘rare earth crisis’, triggered by a conflict between Japan and China, 90% of primary mining was in Chinese hands. Now this number is closer to 60%. There are other players, like Australia, Myanmar and the US emerging in the field.” There are certainly enough rare earth deposits outside China which could furbish our fast-growing needs in the transformation of the energy sectors or the electrification of our infrastructure and mobility. Gutfleisch sees a very interesting potential partner in Brazil. But some of these alternative sources are by no means unproblematic. Gutfleisch points out that in Myanmar rare earths carry all the attributes of being conflict materials, rather than just critical materials.

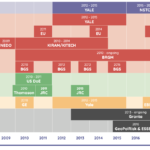

The following steps – isolating rare earth oxides into individual elements and metallizing the rare earth oxide to get the pure rare earth element – are still much more concentrated in China, which is responsible for 90% of global processing. Out of the pure rare earth element, alloys are made. Neodymium, for example, is mixed with iron to make a high-performance neodymium-iron-boron magnet, which remains the undisputed champion among permanent magnets for applications around room temperature. The production of these magnets, used in electric motors, hard drives or wind turbines, is again largely dominated by China, with roughly 10% in Japan and less than 1% in Europe.

Diversifying Supply

According to Gutfleisch, the main obstacles to sourcing rare earths outside of China are legal reasons and cost: “China makes a strategic sacrifice in terms of ecology and social aspects to mine rare earths in a relatively cheap and severely subsidized way. The European community rejects the idea of a strategic subsidy, which in my opinion, is necessary to progress.”

Gutfleisch points out that, despite the immense economic leverage of rare earths, and given their small tonnage in compared to other commodity metals, as well as the comparatively low investment needed for mining, extraction and separation, both industry and policy actors in the EU remain shockingly inactive in developing a secure rare earth supply. He adds that a bit of momentum might now be developing in Europe, although he notes: “It is a rather cynical observation that it is less the transformation towards energy and carbon efficiency, but the use of rare earths in the defense industry which drives this change in mentality and attention.”

Gutfleisch mentions Japan, which has diversified its supply through a strategic partnership with Australia, as a positive example. Through targeted investment in its rare earth supply chain since 2010, Japan can now secure some of its rare earths from Australia.

Another difficulty Gutfleisch mentions is the bad reputation of rare earth mining. The negative image stems from the small but notable presence of radioactive elements in the tailings of some rare earths. This has to be and can be addressed properly, by ensuring that the chemicals used are in a closed cycle and are recycled. The same goes for the significant amount of water used. “Anywhere in Europe these factors would create significant resistance in the local population.”

The criticality of rare earths drives material scientists, including Dr. Gutfleisch, to look for substitute materials. A search which proves to be difficult when it comes to the rare earths used in permanent magnets. Currently, there is a huge gap between low-performance, low-cost ferrite magnets and high performance high-cost rare earth magnets. Ideally this gap could be filled with another material, which is affordable, sustainable and accessible and performs significantly better than ferrite. To find a material like this, it’s important to understand what properties make a magnet strong.

What Makes a Strong Magnet?

To make a very strong permanent magnet, a material must have certain intrinsic magnetic properties. The material must have a high saturation magnetization, the state at which further increases in applied external magnetic field no longer increases the material’s magnetization. It also needs a high Curie temperature, meaning the temperature above which the material loses its magnetic properties. And importantly, the material must have high magnetocrystalline anisotropy. A material is anisotropic, when it exhibits different properties when measured along different axes. If a material has a high magnetocrystalline anisotropy, it takes a lot more energy to magnetize it in certain directions than in others.

When the material is processed first into an intermetallic compound and then into a real magnet, these intrinsic properties are translated into technical extrinsic properties. One of these extrinsic properties is the remanent magnetization, which means the magnetization left behind in a material after the external magnetic field is removed. Another is the energy density, referring to the amount of energy stored in the magnet. The third extrinsic property is the coercivity: the resistance of a magnet against demagnetization in an opposing magnetic field. Until this critical field is reached, the magnet can operate stably, for example, in a motor application. Magnets with high magnetocrystalline anisotropy tend to have high coercivity.

“All the rare earths free alternative potential materials we know to date don’t have that high magnetocrystalline anisotropy provided by the enormous spin-orbit coupling of the rare earths. That is true for manganese-aluminium, iron-phosphide, iron nitrides or iron nickel”, Gutfleisch explains. “An alternative would be to look at 5d metals, such as platinum, which also have a high magnetocrystalline anisotropy. But they’re extremely precious and expensive, so they are even more prohibited in terms of supply and price than the REEs. In any case, a rare earth free permanent magnet filling the above-mentioned gap would be a truly disruptive innovation.”

Advanced Synthesis and Heat Treatment

So, one option to improve the performance of substitute materials is to search for ways to increase their magnetocrystalline anisotropy. This could feasible be done through advanced synthesis and heat treatment. Iron-nickel, for example, has a cubic crystal structure and is therefore isotropic as a starting point. By intelligent heat treatment, the original cubic structure could be transformed into a tetragonal structure that is a prerequisite for increased anisotropy.

But Gutfleisch notes, “Even if you manage this, these anisotropies are, at their best, only a quarter or one fifth of the anisotropy of a rare earth-based intermetallic.”

Rare Earth Lean Magnets

Instead of completely eliminating the need for rare earths, other research is focusing on making magnets “rare earths lean”. For instance, moving from a neodymium-iron-boron-magnet (with a ratio of Nd2Fe14B) to a samarium-iron magnet (Sm1Fe12), that relies less on rare earths. When making a rare earth leaner magnet it’s easy to run into other problems, however. In a monazite or bastnäsite ore, which are the most mined REE ores, the abundance of samarium is less than one-third of that of neodymium. “So, if you make a rare earth lean magnet based on samarium, you can easily run into another criticality issue”, Gutfleisch states. “But on the other hand, you can argue, let’s make full use of the rare earth basket. Because you need to mine all of them together and you need to extract and separate all of them”, he adds.

Free Rare Earth Magnets

Cerium and lanthanum are so-called free rare earths. They’re the first two elements we extract and are the most abundant. This availability makes them cheap and an attractive candidate for Gutfleisch: “We have promising developments to make magnet where we substitute significant amounts, up to 30%, of neodymium with cerium. You end up with a magnet that is not as super high performing, but still very good, and certainly far, far better than the low-cost, low performance iron ferrite magnet.”

Opportunities in Recycling

Gutfleisch urges that we also don’t neglect the potential of recycling, although efficiently recycling rare earth magnets is not an easy task. In theory, recovering neodymium from a neodymium-iron-boron magnet should be highly viable, as the material is clean, separated and present in a very high concentration of 30-40%. Yet, in practice, the design and economics of disassembly remain major barriers: “Design for recycling is extremely important. If I assemble a motor in ten seconds, can I disassemble it in ten seconds? Most likely not at the moment. And if I spend one hour disassembling the motor, then I have no economic case.”

Gutfleisch sees the merits of both short- and long-loop recycling. In short-loop recycling, the functional hard magnetic phase isn’t destroyed in the recycling process, which means a lot less energy is invested. In a recent publication examining short-loop recycling, Oliver Gutfleisch and his team have shown that magnets made out of recycled material are at least equally good as primary magnets.

“On the other hand, if you have an undefined, end-of-life basket of magnets, if you don’t really know what is in there, or the stuff is severely corroded, then you need to go to long-loop recycling.”

In long-loop recycling the different rare earths are re-separated into rare earth oxides. Remelting the material is highly energy intensive. “But the advantage is that you start from scratch and you’re completely free to make whatever out of it. It doesn’t need to be a magnet, you can use it for a catalyst material, or for something else”, Gutfleisch explains.

A problem with rare earth recycling lies therein, that because of the global situation, scrap magnet prices have increased tremendously, Gutfleisch states. It’s an issue he encountered himself at a pilot-scale recycling facility of Fraunhofer IWKS in Hanau: “It’s by no means easy to find well-identified, quantified and reasonable priced scrap magnets in sufficient quantity to have a reliable recycled magnet source for the coming years.”

Other Potentials

In an attempt to use less rare earths in motors, materials scientists are also collaborating with motor designers. If motor designers are willing to redesign the shapes and arrangement of their motor’s components, efficient motor applications using less rare earths could be achieved, according to Gutfleisch. However, these designs don’t reach the performance levels as motors incorporating neodymium-iron-boron magnets.

Also, some new motor designs require embedded arc-shaped magnets, which are usually carved out of a block of sintered magnets. Gutfleisch points out that this is inefficient: “You can easily imagine that we have 30%, even up to 50 % of waste material.” He sees an alternative in net shaped magnets by hot deformation, a process whereby a full density and texture magnet is imprinted into an arc segment. This would mean the waste created by carving could be avoided.

Finally, machine learning could assist in creating magnetic material libraries by enabling the rapid identification and prediction of properties for a wide range of compositions and structures. “But this is more my vision than reality at the moment. We need to be a bit careful with, in my opinion, over-hyped promise. The predictive power of the various simulation tools is still limited. I still believe very much in experiment, but machine learning is now an element in our daily research.”

Looking Ahead

From the creation of heavy rare earth free magnets to rare earth lean magnets to magnets utilizing free rare earths or even no rare earths at all – numerous strategies to reduce our reliance on these critical materials are being explored, among others by Oliver Gutfleisch at TU Darmstadt, in the DFG sponsored collaborative research center CRC/TRR270. Yet a true substitute remains elusive. In the meantime, diversifying supply sources and developing efficient recycling are essential to managing what Gutfleisch aptly describes as a “problematic treasure”. In Europe we need to cover the entire value chain, not just parts of it. That doesn’t mean that everything has to happen in Europe, but we should make the most out of our rare earth resources and use them wisely for a more sustainable future.