EU Critical Raw Materials Act as an answer to the US Inflation Reduction Act

IRTC industrial advisor Anthony Ku shares his impressions from the European Commission’s #RawMaterialsWeek: The Critical Raw Materials Act – Europe’s clean energy supply chain answer to the US Inflation Reduction Act.

This week, I had the pleasure of attending the EU’s Raw Materials Week in Brussels. It is an annual gathering of people – mainly from Europe, but with others (like me) from other parts of the world – to discuss the latest challenges and opportunities related to critical materials issues in the European context.

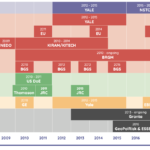

Geopolitics was understandably high on the agenda, with lots of discussion about how far Europe should go in reshoring supply chains (including the possibility of opening new mines on the continent). I found the discussion about the impacts of the US Inflation Reduction Act (IRA) particularly interesting.

According to one industry speaker, the incentives for domestic battery manufacturing capacity are now nine times greater in the US relative to Europe. This has raised questions about how to “level the playing field” for European industry not just with China, but also in light of the new incentives offered by the US for restoring clean energy supply chains to North America.

In September 2022, EU President von der Leyen announced a European Critical Raw Materials Act. The broad outlines of the initiative have been laid out, and multiple speakers from the policy world talked about the need to make it “big, smart, and fast”. Efforts to define specific incentives, regulations, and other relevant policies are underway, with the process currently in a public comment period until November. Comments on the process and the ability to add your voice can be found here [2]; it’s worth taking some time to read through what is being said if you are actively working in this space.

For those interested in critical materials and global supply chain issues, this bears watching, as Europe’s next move to “level the playing field” changes the game once again.

Personally, I’m very interested in seeing over the next few months:

- Whether this is the start of an incentives “arms race” between the EU, US, China, and other parties for raw materials supply?

- How this impacts coordination between the US and EU on common interests (e.g., responsible sourcing) relative to China’s position in global supply chains?

- How the Act might impact the evolution of carbon pricing in the EU and possibly globally?

References:

- European Commision (2022). Critical Raw Materials Act: securing the new gas & oil at the heart of our economy I Blog of Commissioner Thierry Breton. https://ec.europa.eu/commission/presscorner/detail/en/STATEMENT_22_5523

- European Commision. European Critical Raw Materials Act. https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13597-European-Critical-Raw-Materials-Act_en